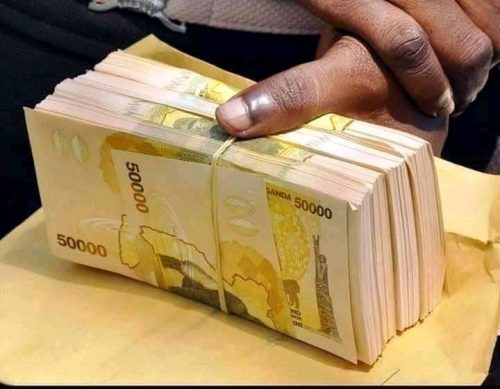

Stanbic Bank loans to SACCOs hit Shs 55bln

KAMPALA – Savings and Credit Cooperative Societies [SACCOs] have so far received loans worth Shs 55 billion from Stanbic Bank Uganda, according to Patrick Twinamatsiko, the head of SACCOs business at Uganda’s largest bank by market capitalisation.

Speaking during a stakeholders’ engagement early this week at Golf Course Hotel in Kampala, Twinamatsiko said Stanbic Bank offers 12.5 percent without collateral loans, even though the lender further charges 10 percent interest on credit disbursed to SACCOs engaged in the agriculture sector.

“We only require personal guarantees from the directors of the SACCOs for the loan to be processed,” he said, adding that the Bank has also helped to digitise 150 SACCOs.

Emma Mugisha, the Stanbic Bank head of business banking said SACCOs in Uganda will play a leading role in increasing investments which will further create more opportunities for nationals.

Mugisa said the bank offers training programmes on financial literacy, mindset change, and business incubation.

“We can guide SACCOs on areas of investment which give them economic returns on their investments,” she said, adding investment in businesses like treasury bills, bonds, unit trusts, buying land and developing properties give good returns to investment.

Speaking during the stakeholders’ meeting, Fred Mpagi one of the leaders of SACCOs based in Kyotera district, said SACCOs engaged in agriculture in the area have benefited from the 10 percent interest rate offered by Stanbic Bank on loans which come with a grace period of three months.

Sheila Atim, the chairperson of Parliament Staff SACCOs pointed out financial indiscipline by some members as the biggest challenge that needs to be addressed. “One of the challenges SACCOs are struggling with is financial indiscipline of some of their members who misuse their savings,” she said.

A SACCOs’ development officer in the Finance ministry Daniel Muganda also urged SACCO leaders to embrace good governance practices if the SACCOs are to prosper.

Danstan Kisuule, the chief executive officer of Y-Save SACCOs which belongs to some of the members of Watoto Church, said SACCOs are important in improving the economic welfare of the members.

“If you want your SACCOs to grow, you have to run it like a business with various investments,’ he said, adding that SACCO members meet monthly to share information, get training, and education on certain topics.

According to the secretary to the treasury, Ramathan Ggoobi there are 10,594 SACCOs under the PDM, 6,700 under Emyooga and 15, 705 registered as other SACCOs.

He recently said in the financial year 2023/ 2024, a total of Shs 1,059 billion has been allocated to PDM SACCOs, Shs 100bln for Emyooga SACCOs, and Shs 4bln for other categories of SACCOs funded under the Microfinance Support Centre [MSC].

https://thecooperator.news/stanbic-bank-uganda-courts-mps-in-push-for-womens-financial-inclusion/

Buy your copy of thecooperator magazine from one of our country-wide vending points or an e-copy on emag.thecooperator.news