SHEEMA – The chairman of Mushanga SACCO, Gilvazio Bafaki alongside other former members of the board was last Saturday unanimously re-elected to serve for the second term of office, which takes four years.

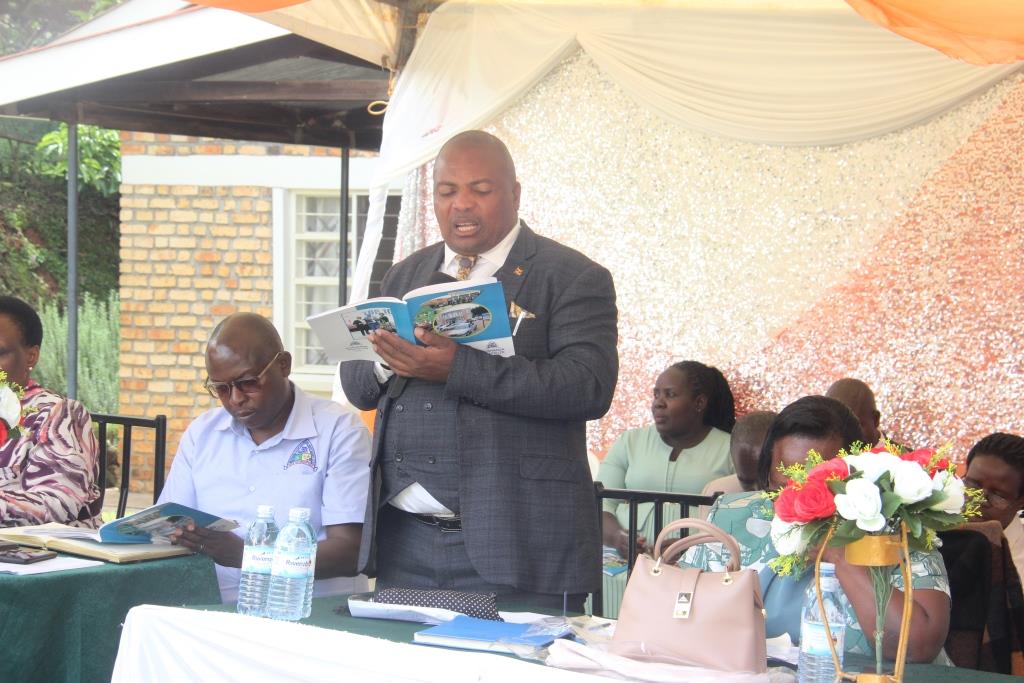

The new board members were elected during the SACCO’s 41st annual general meeting [AGM] held at Mushanga Social Training Centre in Sheema Municipality.

The general manager, Gorden Nankunda said most of the former board members were re-elected by delegates to keep Mushanga SACCO thriving.

According to Nankunda, the elective AGM was attended by about 400 delegates each representing 100 clients from the SACCO’s 12 branches.

The vetting committee chairman, Adrian Tushabe reported that out of nine board members, six applied for re-election without being challenged.

These include; Gilvazio Bafaki [chairman], Vincent Asiimwe [vice chairman], Matia Barigye [treasurer], Patricia Neema [secretary], Evelyn Arinaitwe [member] and John jones Mubagangizi [committee member.

According to Tushabe, the other three special interest group members were subjected to a democratic vote to fill the nine-member board of the SACCO.

The delegates further elected Sam B. Ahimbisibwe, Rose Arinaitwe Kamugisha and Austin Ahimbisibwe as the audit and supervisory committee members.

Bafaki urged members to increase the shareholding in the SACCO to boost liquidity which is a factor that enables the disbursement of loans to members.

“We have been having a share capital of only Shs 18 billion but now we expect our share capital to rise to Shs 30bln in four years to come and we also expect at least every year to add Shs 10bln loan portfolio. So, by the end of the four years, we expect to be having Shs 80bln loan portfolio,” Bafaki told delegates at the AGM.

He said Mushanga SACCO faces the challenge of multiple borrowers which he said requires redress if the number of defaulters is to be reduced.

During the AGM, a health insurance scheme was recommended for the members of the SACCO. This, according to members would help members to get specialised treatment for some diseases.

“In 2022 we lost over 60 members. Instead of rushing to condole the bereaved families , we have introduced a new product where SACCO members can pay a premium to get affordable treatment from our health partners,” Bafaki said.

The AGM also recommended increasing the maximum liability from Shs 5bln to Shs 10bln and not exceeding Shs 30bln external borrowing as a bid to increase the loan portfolio.

Sheema Municipal Council principal commercial officer, Nicholas Kagurusi appealed to the SACCO always be careful in decision taking to avoid making losses.

“Whereas delegates pray for branches, we must be so calculative because the more we open branches, the more the costs and likelihood of leakages. It is my humble plea that as we expand let’s look at the membership that we have in those places,” Kagurusi emphasised

The vice chairman of Uganda Credit Society Cooperative Union [UCSCU], Steven Bongonzya challenged the parliament to address the issue of multiple regulations. “I appeal to my fellow cooperators to advocate for a single regulator,” he said.

Sheema district Woman Member of Parliament, Rosemary Nyakikongoro who was the chief guest at the AGM, pledged to raise the issue of multiple regulations in parliament.

“As Members of Parliament, we want to commit this to the Speaker because you cannot put SACCOs under the Bank of Uganda,” Nyakikongoro said.

“With the government insisting that some big SACCOs be regulated by the Bank of Uganda, it means they will turn into commercial banks. Are people ready to turn their SACCOs into commercial banks? For us as Members of Parliament, we think all SACCOs are equal and we are not going to support double regulation. We want UMRA as the regulator. Let the Bank of Uganda concentrate on commercial banks,” Nyakikongoro said.

The AGM was attended by several partners such as; aBi, Association of Microfinance Institutions of Uganda [AMFIU], UCSCU, Uganda Central Co-operative Finance Services [UCCFS], and Financial Sector Deepening Uganda [FSDU], MasterCard Foundation, and district commercial officers, among others.

Background

Mushanga SACCO was started in 1969 and later registered as a Co-operative Society in 1981.

In 2022, it made a surplus of Shs 2.3bln and after deducting allocations it remained with a net surplus disposable dividend of about Shs 1.8bln where the delegates resolved to retain 30 percent as corporation tax, 40 percent given to members as non-cash dividends and 60 percent as cash dividends.

Currently, Mushanga SACCO has 12 branches, with a total of 42,760 members, share capital of about Shs 9.6bln, Loan portfolio of about Shs 33bln total savings of about Shs 18bln, and total assets of about Shs 36.4bln.

Buy your copy of thecooperator magazine from one of our country-wide vending points or an e-copy on emag.thecooperator.news