KAMPALA, June 28, 2024 – Money lenders and, Savings and Credit Cooperatives [SACCOs] in the country that have a habit of holding on to national identity cards [ IDs] of their clients have been warned to stop the vice with immediate effect, or else they will face the strong arm of the law.

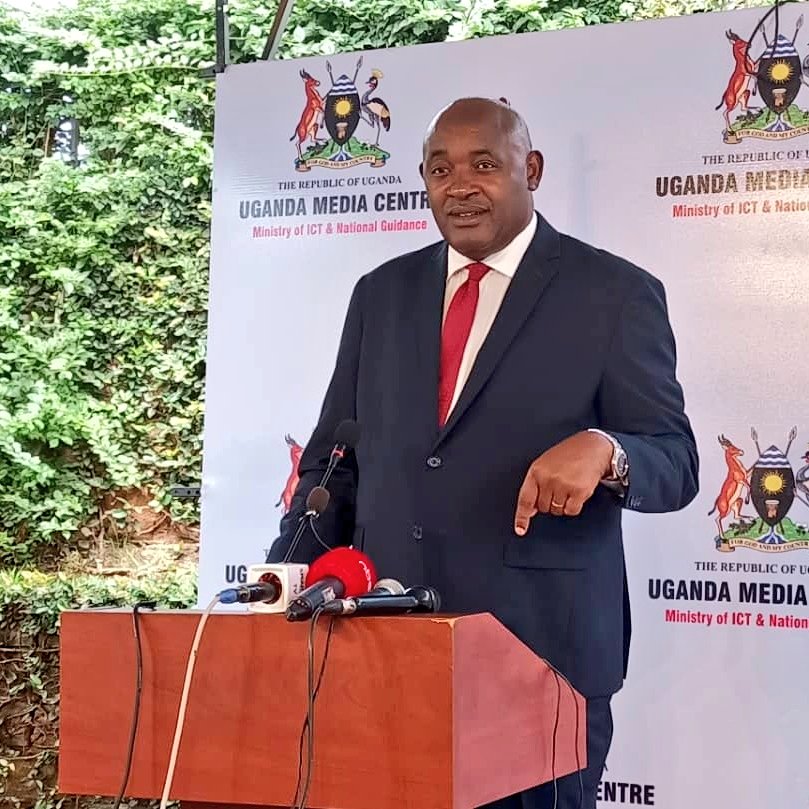

This was aired out this Friday by the Ministry of ICT and National Guidance Dr. Chris Baryomunsi while briefing the press at the Uganda Media Centre in Kampala on recent Cabinet decisions and the Attorney General’s directive regarding money lenders using national IDs as collateral.

“It is illegal and unlawful for anyone to require a borrower to bring their IDs. So that goes without saying that, those who are holding people’s IDs should return them as soon as yesterday. So this is an instruction that all the moneylenders, all the SACCOs. All the institutions that lend out money should not be holding people’s IDs. And if they are holding them, please return them and negotiate afresh the kind of collateral, that person should be able to deposit,” advised the minister.

Baryomunsi added that the media address was a direct instruction by government to moneylenders to return any IDs in their possession immediately.

However, money lenders told this reporter that most of the people who come for loans don’t have anything to present as collateral, apart from the national IDs, much as government says both fixed and movable items can be used as collateral.

“It is not that we want to keep the national IDs of the borrowers. Most of our borrowers are poor that they don’t have land titles, or assets such motor vehicles, and others. So we take their IDs a collateral to be sure we will be paid,” said Junior Kamanzi, a money lender in Kampala’s central business district, adding that those who clear their loans receive back their national IDs.

In the past, Uganda Microfinance Regulatory Authority [UMRA] which licenses and supervises money lenders and SACCOs in the country has warned against use of national IDs as collateral.

That aside, he argued government has a responsibility to regulate and cap interest rates charged by some lenders to protect citizens, adding that the government is carrying out research and consultations to establish effective safeguards in the local money lending business.

on online scammers, the minister warned the public to be careful, saying chances of losing one’s money are high. “We want to caution the public to be careful. Much as we promote technology and want people to go digital, we also know there are conmen who would want to fleece people of their money. So, you should be careful.

For people to engage in this kind of business, the minister said, they should be licensed properly. “Otherwise, anyone can just go behind a computer, behind a phone, and just claim that they are a moneylender,” he said. “We are about to study this issue and work with the Bank of Uganda [BoU] and Uganda Communications Commission [UCC], and issue further guidance to Ugandans on the issue of online lending services.”

He said the Appropriation Bill was returned to Parliament because President Yoweri Museveni found out that there were alterations that were made within the parliament on the budget, which fundamentally distorts what Govt plans to do in the next financial year 2024/2025 which begins on July 1, 2024. “Shs 750 billion was diverted to areas, which the government thinks is a diversion from the priorities which the government had set.”

On June 14, 2024, Finance Minister Matia Kasaija read a Shs 72 trillion national budget to Ugandans, with a significant portion of being earmarked to bay debts, leaving just over Shs 50trn for government spending.

https://thecooperator.news/lack-of-national-ids-frustrating-eacop-compensation-process/

Buy your copy of thecooperator magazine from one of our country-wide vending points or an e-copy on emag.thecooperator.new