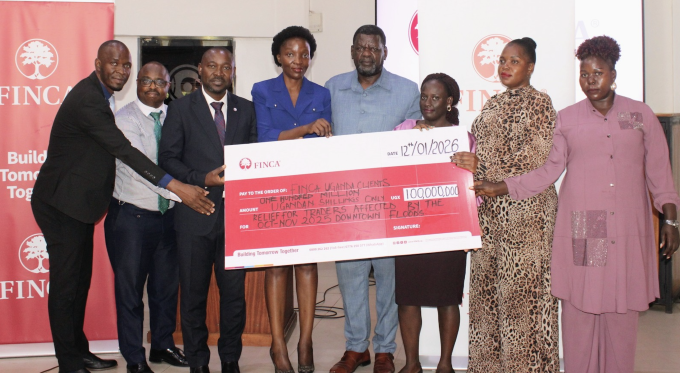

KAMPALA, January 25, 2026 — FINCA Uganda has committed more than Shs100 million towards a relief initiative aimed at supporting traders whose businesses were severely affected by flash floods caused by heavy rains in late October and November 2025.

The intervention was announced during a recent press conference held at Fairway Hotel in Kampala, which brought together affected traders, city officials and other key stakeholders.

FINCA Uganda said beneficiaries were identified through a comprehensive verification exercise conducted in collaboration with trader leaders and local authorities to assess the extent of flood-related losses.

The relief package will be disbursed in phases to ensure timely and sustained support as traders work to rebuild and restore their businesses.

The floods caused extensive damage to basement arcades and commercial premises in areas including French Plaza, Pentagon City Plaza, Totala Business Centre and surrounding locations.

Traders reported heavy losses after floodwaters destroyed merchandise such as clothes, mattresses, carpets and other goods, forcing many businesses to temporarily close.

Speaking at the briefing, FINCA Uganda Chief Commercial Officer Eva Balikowa said the institution’s response went beyond financial services to supporting livelihoods during times of crisis.

“Behind every flooded shop is a family, a livelihood and years of hard work. We deeply sympathise with traders who are the backbone of Kampala’s economy. As FINCA Uganda, we are committed to standing with entrepreneurs in moments of crisis. The relief will be provided in phases to ensure traders can recover steadily,” Balikowa said.

The intervention was welcomed by the business community, with the Kampala City Traders Association (KACITA) describing it as timely and critical.

“This support from FINCA Uganda comes at a time when many traders are struggling to get back on their feet. It demonstrates responsiveness and partnership with the trading community and will go a long way in restoring business confidence,” said Issa Ssekito, Acting Chairperson of KACITA.

FINCA Uganda also worked with its insurance partner to support affected clients with active loans. Ismail Balikoowa of Padre Pio said traders whose businesses were damaged by the floods benefited from insurance claim payouts that helped settle outstanding loan balances.

“We conducted on-ground assessments in the downtown area to verify the affected borrowers and facilitate the necessary support. We deeply sympathise with all traders impacted by the floods,” Balikoowa said.

For traders on the ground, the relief has brought renewed hope. Charlotte Owomugisha, a businesswoman operating from the French Plaza basement, said the floods had nearly wiped out her livelihood.

“I got a loan of Shs6 million from FINCA Uganda and stocked children’s clothes, but the floods submerged my business. I lost hope after the incident, but with this support from FINCA, I am now hopeful that my business will recover,” she said.

The floods have once again highlighted Kampala’s drainage challenges, with experts pointing to blocked waterways and construction activities along the Nakivubo Channel as factors that worsened flooding in low-lying commercial areas.

Kampala Capital City Authority [KCCA] has since intensified efforts to improve drainage infrastructure along key roads in the city centre to mitigate future flood risks.

FINCA Uganda reaffirmed its long-standing commitment to supporting small and medium-sized enterprises across the country through tailored loans, business training and advisory services aimed at strengthening resilience and promoting sustainable growth.

Closing the event, FINCA Uganda Executive Director Robert Kakande said the institution remained a dependable partner for traders during difficult times.

“We value the trust our clients place in us, especially during challenging moments. FINCA Uganda remains a reliable partner to traders as they rebuild, grow and plan for the future. We welcome both existing and new entrepreneurs to explore our financial solutions designed to support business growth,” Kakande said.

https://thecooperator.news/bank-of-uganda-issues-mdi-licence-to-ebo-sacco/

Buy your copy of thecooperator magazine from one of our country-wide vending points or an e-copy on emag.thecooperator.news