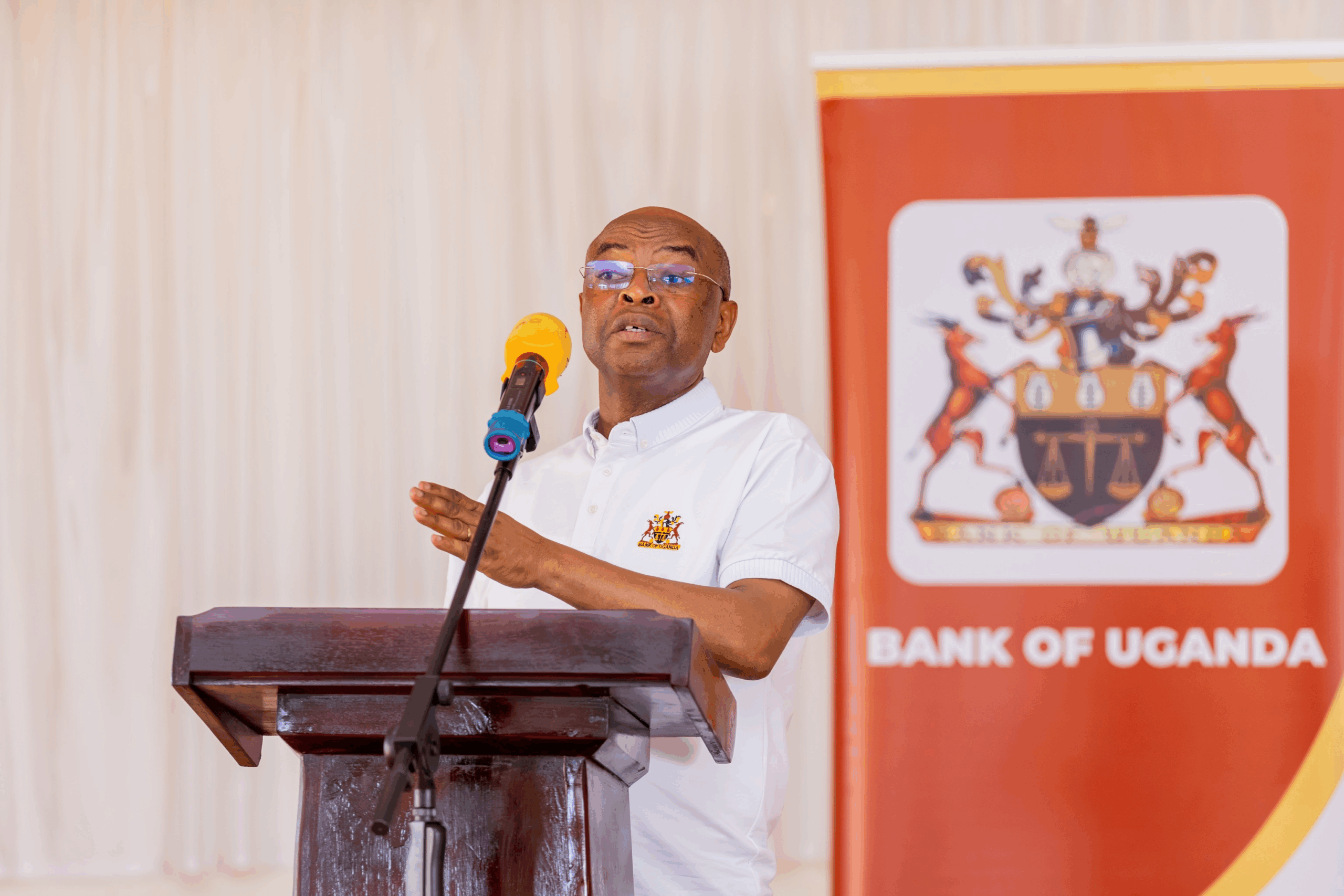

BUSHENYI, May 25, 2025 – – The Deputy Governor of the Bank of Uganda [ BoU ], Prof. Augustus Nuwagaba, has reaffirmed the central bank’s commitment to inclusive economic growth and financial stability during a town hall meeting held in Bushenyi district recently.

Addressing local residents, local leaders, and business owners, Nuwagaba emphasised the central bank’s pivotal role in Uganda’s socio-economic transformation, a mandate that extends well beyond the realms of monetary policy.

“Established in 1966, the Bank of Uganda is the nation’s central bank. Its core responsibility is to ensure price stability and maintain a sound financial system, two pillars that support Uganda’s economic progress,” said Nuwagaba. “These are not abstract functions; they affect the daily lives of Ugandans, from the cost of bread to the security of savings in commercial banks.”

The town hall meeting formed part of BoU’s wider public outreach campaign to increase financial literacy and awareness of the Bank’s functions. Nuwagaba outlined several strategic focus areas, including inflation control, regulation of financial institutions, digital payments, financial inclusion, and the promotion of sustainable finance.

On inflation, the Deputy Governor highlighted the Bank’s success in maintaining price stability:

“By ensuring low and stable inflation, we protect the purchasing power of households, particularly those with fixed or limited incomes. It shields them from the erosive effects of rising prices,” he said.

He praised Uganda’s ability to keep inflation below 5 percent despite global economic turbulence, attributing this to transparent and data-driven monetary policies.

Prof. Nuwagaba also addressed the importance of financial sector oversight, the growing relevance of mobile money, and the critical role of national payment systems.

“We ensure these systems are secure, efficient, and accessible, empowering households and businesses to transfer funds reliably and affordably,” he said.

In a region where agriculture is a dominant livelihood, the BoU Deputy Governor urged farmers and agribusinesses in Bushenyi, Mitooma, and other nearby districts to take advantage of the Agricultural Credit Facility [ACF], which offers loans at interest rates of up to 12 percent per annum through supervised financial institutions.

He also referenced the Small Business Recovery Fund [SBRF], introduced in the aftermath of the COVID-19 pandemic to provide affordable credit to small and medium enterprises [SMEs] with recovery potential.

In line with global banking trends, Prof. Nuwagaba noted the Bank’s growing emphasis on Environmental, Social, and Governance [ESG] principles. Through initiatives such as the Sustainability Standards and Certification Initiative, BoU is encouraging banks to adopt climate-conscious lending practices and support social development projects, including health facility upgrades in areas like Mitooma district.

Prof. Nuwagaba reiterated the Bank’s long-term commitment: “The Bank of Uganda is fully dedicated to maintaining price stability and building a robust, inclusive, and resilient financial system. True development is measured not only by GDP but by the improved well-being of all citizens.”

The town hall meeting concluded with a Q&A session, during which BoU officials responded to residents’ concerns about interest rates, access to loans, and the safety of bank deposits.

The event marked a significant step in the implementation of BoU’s Strategic Plan [2022–2027], which aims to deepen public engagement and promote sustainable, people-centred economic development across Uganda.

https://thecooperator.news/bou-to-regulate-mortgage-financing-entities/

Buy your copy of thecooperator magazine from one of our country-wide vending points or an e-copy on emag.thecooperator.news