KAMPALA – MPs on parliament’s Committee on Tourism Trade and Industry, have declined to approve Shs 10.5 billion requested by Uganda Ware House Receipt System Authority [UWRSA] to refurbish storage facilities, saying that the planned activity is outside of the Authority’s mandate.

This is contained in the Report of the Committee on Tourism Trade and Industry on the Ministerial Policy Statements and Budget Estimates for the financial year 2022/2023.

UWRSA under the Ministry of Trade Industry and Cooperatives [MTIC] has asked for a total of Shs 15.067 bln in the financial year 2022/2023. If the committee’s recommendation is upheld by the House, it means UWRSA will have its budget cut, as there will be no money to repair the storage facilities.

The agency was established under section 3 of the Ware House Receipt System Act, 2O06 to; Iicense warehouses, license warehouse keepers, license warehouse inspectors, issue negotiable warehouse receipts books, carry out, and perform such other functions as are conferred or imposed on it by this Act or regulations made under the Act.

The MPs in their committee report say UWRSA can only expand its mandate via an Act of Parliament or regulations.

“The Managing Director of the Ware House Receipts Authority is advised to seek an amendment of the Warehouse Receipt System Act, 2006 in order to expand its mandate, the report says.

The MPs in the report say giving money to UWRSA to repair storage facilities and provide metrological infrastructure will allow it to participate in activities that are licensed by itself under the Act it was established. “This will make the Authority a regulator while at the same time participating in the industry it regulates.”

The report says the funding of the activity will further have a detrimental effect on the execution of the mandate of UWRSA. “The Authority will concentrate more on establishing warehouses rather than regulating the provision of the objectives of the Act.”

Furthermore, MPs say, allowing the Authority to participate in the industry it regulates results in ‘Regulatory Capture’.

“The concept of Regulatory Capture typically refers to a phenomenon that occurs when a regulatory agency that is created to act in the public interest instead advances the commercial or political concerns of special interest groups that dominate an industry or sector the agency is charged with regulating.”

When regulatory capture occurs, the interests of firms or political groups are given priority or favor over the interests of the public. There is a likely hood that the Authority will prioritize the commercial interests of its undertakings rather than the public interest objectives for its establishment, the report says, adding that UWRSA will be acting ultra vires to its mandate and Parliament should not facilitate it to commit such illegality.

The committee in its report says UWRSA has continued to hold money across financial years without disclosure. “For instance, at the end of the FY 2O2Ol21 the authority did not transfer Shs 4.87 billion into the consolidated fund, as required by the law.”

That Section 17 (2) of the PFM Act, 2015 requires that all the unspent balances at the end of the financial year be transferred to the consolidated fund.

The committee in its report has asked the accounting officer in MTIC to ensure the money is transferred to the consolidated fund but at the same time asked parliament not to give UWRSA the Shs 10.5bln, saying giving the agency the money would be an illegality.

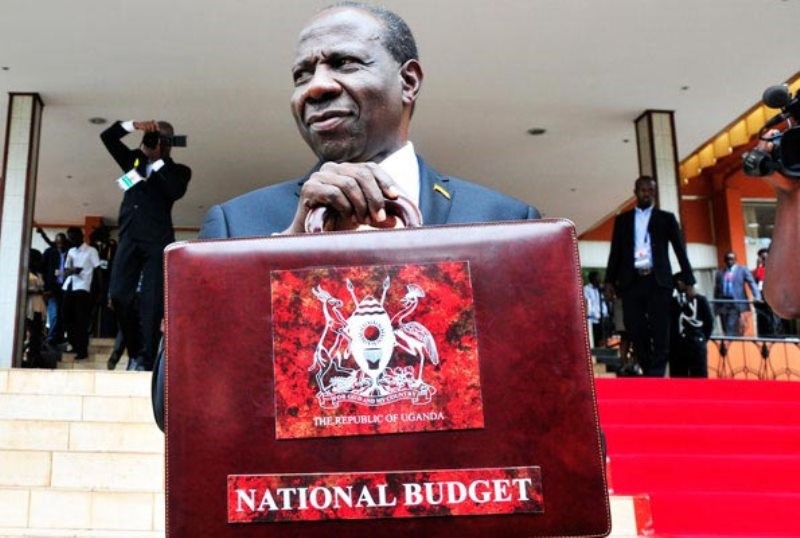

Government has earmarked about Sh47 trn for spending in the coming financial year. Parliament appropriates the national budget and MPs are tasked to wipe out unnecessary expenditures of ministries, departments and agencies (MDAs), especially in a country with a limited resource envelope, moreover with a huge public debt to pay.

Buy your copy of theCooperator magazine from one of our countrywide vending points or an e-copy on emag.thecooperator.news